Teresa Sabatine: Film Indy’s Leading Lady

The scene opens in a desolate city. Faded posters from Going All the Way and Hoosiers hang throughout town, but the studio lights shipped to places like Pittsburgh long ago. The camera pulls back to reveal a woman surveying the streets she left behind in her youth for a career in show business. If only they gave producers a reason to come …, she thinks to herself. Down the road, a few state senators cast sideways glances at her as they enter the Statehouse. A storm gathers in the distance.

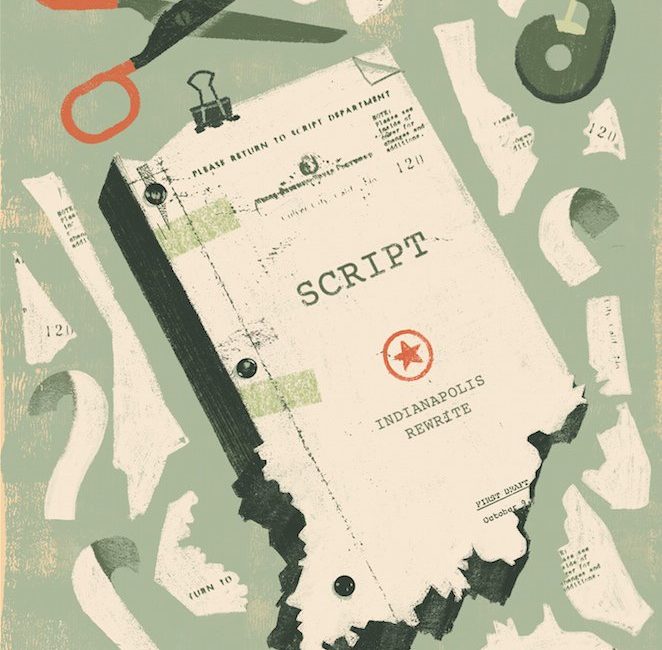

As the opening to a movie, it may seem a little hokey. But a real-world drama along those lines is coming to a legislative session near you. Once competitive in film and television production, Indiana has fallen the way of Blockbuster in recent years as other states lured shows away with generous tax incentives. Last summer, a new initiative called Film Indy hired its first commissioner, Teresa Sabatine, to help change that. A Ball State graduate, Sabatine spent almost a decade producing projects for Lionsgate and 20th Century Fox before returning home to Indiana. She won’t be the first to try to revamp the culture here. After a modest tax incentive for films expired in 2012, several lawmakers have tried to introduce similar bills at the Indiana General Assembly—and always failed. Next month, Sabatine and a team of local advocates make their pitch to the skeptics in the House of Representatives once again in the form of the Indiana Film and Media Production Tax Incentive bill.

Will they find a receptive audience? Those hoping for a happy ending might take some comfort in the fact that the proponents come armed with a lot more data this year than they have in the past. Thanks to research from The Media School at IU, the authors of the bill will present case studies from other states, identify specific productions to target, and pinpoint the number of Hoosiers who rely on this kind of work. Perhaps no one has more riding on the proposal than Sabatine. Her job—the entire Film Indy initiative, in fact—runs for just 18 more months. Without state tax incentives, selling Indiana to filmmakers will be as tough as finding the funds to extend her own contract.

Yet Sabatine is undaunted. Every protagonist needs to overcome a little adversity, after all. Maybe the fact that almost 40 states already have tax incentives just makes hers a better story—one with parallels to Hoosiers itself. “We’re behind, but aren’t we always?” she says. “This gives us an opportunity to surprise some people.”

Blame Louisiana. Until the Pelican State introduced the first tax incentive for film production in 1992, television and movie producers tended to choose locations based on the landscapes and infrastructure that made sense for the project. Louisiana’s experiment changed that. Film investors began demanding locations that returned some of the money they spent in the form of a tax credit. That started an arms race among states not named California. Illinois, Ohio, and Kentucky were quick to offer such incentives to entice crews to the Midwest. Indiana finally came around in 2007, when the legislature passed a 15 percent tax credit for film with a $2.5 million annual cap. Compared with its neighbors, the Hoosier incentive amounted to little more than a cameo. During its five years in existence, the program wasn’t marketed in Hollywood and faced stiff competition from places like Michigan, which offered as much as 42 percent of expenses back up to a $115 million cap. Public Enemies and a few other notable movies were filmed in Indiana during that period, but even the original authors of the local bill concede the credits were underused. When the 2012 sunset date arrived for the law, few advocates were left to champion a new one.

Cue the ominous music: A slump ensued. According to a Motion Picture Association of America study, just six TV shows or movies were made here in 2013–2014, compared with 37 in Illinois, 17 in Ohio, and 22 in Michigan. One blog that covers the industry, PremiumBeat, called Indiana the fourth-worst place in the country to film in 2014. Infamously, 20th Century Fox chose to spend $14 million shooting local author John Green’s The Fault in Our Stars—written here, set here—in Pittsburgh. In 2015, state representative Christina Hale introduced a bill to bring back tax incentives, but that never made it out of committee. The only sizable productions passing through Indiana the next couple of years either required a particular landmark (like Columbus, a John Cho film that shot in the modernist architecture mecca in August) or landed here against their own financial interests.

New York producer and IU grad John Armstrong will be the first to admit that his film, The Good Catholic, is an example of the latter. Shot in Bloomington last February and starring Danny Glover, the independent film will hit the festival circuit this winter. “Filming in Bloomington was an emotional decision, not a fiscal one,” Armstrong says. “We knew the city, and we thought we could get some help from local businesses. I went to Bloomington Ford, and they loaned us four free cars and two 18-passenger vans. I went to the Grant Street Inn, and the manager gave us several rooms free of charge. Now, that’s not a sustainable model. And had our investors not been Indiana people, they wouldn’t have done it anyway.”

Armstrong and his partners at Pigasus Pictures hope to film two more features in Indiana, but those won’t be possible without tax incentives. So he was happy to see the creation of the Film Indy office earlier this year. The Central Indiana Community Foundation, Visit Indy, and the City of Indianapolis each chipped in $100,000 for a two-year pilot. Hiring Sabatine was just the first step. Film Indy will compile a database of locations and local production talent for out-of-state crews to consider. Pushing for tax incentives, however, is one of the office’s top priorities—and not just for major films. Reality shows, commercials, even corporate videos bring money to town. They all support the lighting, camera, electrical, and catering businesses here.

With that in mind, Film Indy, The Media School at IU, and other advocates began consulting on the Indiana Film and Media Production Tax Incentive bill, which state representative Matt Pierce will introduce in the House in January. It calls for more generous credits than last time. Productions over $50,000 would get up to 30 percent back on in-state labor expenses, with a total annual cap of $15 million. In addition to providing work for the nearly 7,000 people in this industry locally, Pierce sees branding value in having media production here. “I remember watching Breaking Away in high school,” he says. “Decades later, people still remark about the backdrop of Bloomington in that movie. That might be shot somewhere else today! If I had my druthers, I’d pass a federal constitutional amendment that outlawed state incentives for industries generally. But you can’t unilaterally disarm. So you have to play the game, whether you like it or not.”

Branding and sporadic employment, though, strike some at the Statehouse as soft arguments for giving Indiana’s money away. State senator Brandt Hershman was one of the most vocal opponents of the film tax incentive push in 2015, and he doesn’t expect to change his vote this winter if the bill makes it to his chamber. Hershman points to a 2016 American Politics Research study that found film incentives had little economic benefit in the states where they were offered. “You have to ask yourself, ‘Is this an area where Indiana wants to develop an expertise as we have in the life sciences and advanced manufacturing?’” he says. “You can make an argument to incent those areas because we have a competitive advantage. But film is not an area where Indiana has historically had a strong presence. Why would you provide taxpayer dollars to help an industry that is not in financial difficulty? We all loved Hoosiers, but the long-term impact on our economy was negligible.”

Flashback to 2008: Sabatine graduates from Ball State with a degree in theater and leaves for New York before the ink is dry on her diploma. She starts as a page on The Late Show with David Letterman. Before long, she is producing shows and films for Lionsgate and 20th Century Fox in Los Angeles. She serves as location manager for Paramount in Chicago. Then Nike hires her to manage video projects at its headquarters in Oregon. After bouncing around the country, Sabatine returns to Indy in late 2015. “I wasn’t even sure why I was coming home,” she says. “I guess I needed a bit of a nap. If I had wanted a film job, this wasn’t the place to be. But because I’m interested in business development, I thought, Maybe I can do something along those lines.”

Sabatine took a job at People for Urban Progress while she planned her next step. And in a twist almost too implausible for the silver screen, the Film Indy commissioner job materialized in early 2016. Since she started in July, Sabatine has chatted with many producers passing through Central Indiana, interviewing them about what went well and what didn’t. She has cataloged promising film locations. She has traveled to New York to press her contacts about bringing productions here. On a recent trip, she met with Al Roker Entertainment and learned of an upcoming TV show about undercover mayors, similar to Undercover Boss. “I thought, Let’s get Joe Hogsett on that show!” she says.

Those meetings were hard to get when she was 22. But after almost a decade in the business, Sabatine feels confident she could land one with Paramount head of production Ralph Bertelle (basically, King of Hollywood) if she had something to sell him. Most of the projects she hopes for don’t carry blockbuster budgets, of course. Indy’s modest community of camera rental businesses and lighting professionals best supports productions under $3 million.

Even attracting those shows and films without tax incentives will be difficult, though. So Sabatine has been lining up filmmakers with Indiana ties to make the case face-to-face with legislators this winter. Angelo Pizzo, producer of Hoosiers, will be there. Armstrong also hopes to participate. For the film commissioner, it will be her first time lobbying for anything. She’s smart enough to know the rest of the state sometimes resents the capital city, so she’s allowing the IU delegation and representatives from rural counties to make the public push. Much of her work takes place behind the scenes. But given the fact that she had to leave Indiana to follow her dream of working in the industry, it’s easy to see why the cause might be personal for her.

“Three times a week, I hear from someone in L.A. who’s from here tell me, ‘I wish I could come home,’” she says. “That’s a disgrace.”

This fall, Visit Indy vice president Chris Gahl and CICF president Brian Payne met with Sabatine at a long conference table to talk strategy. The commissioner educated Payne on film tax incentives. She reported on the shows and movies—House Hunters and Top Chef, among others—she had been chasing for Indy shoots. She shared a story about connecting the Pacers with local production houses for a series of documentaries celebrating the team’s 50th anniversary. But when Sabatine mentioned a recent meeting with former mayor Greg Ballard, she couldn’t hide her concern. A proponent of film tax incentives, Ballard nevertheless had warned her of the long odds of passing them in the current legislature. The discussion with Payne and Gahl quickly turned to contingency plans.

“What if we could pay to play in another way?” Sabatine said. “Maybe private entities with money and interest in the culture of Indianapolis would put their money into a pot—a film fund.”

Payne, a guy with a history of backing long-shot ideas and an admitted cynic about Hoosier politics, nodded his head. “We could prove to Indiana there’s value in this,” he said. “By Year Three, we could expect the state to match us dollar for dollar. By Year Five, it’s time for the state to take over entirely.”

For his part, Gahl expressed optimism about the new film incentive bill and encouraged everyone to keep the faith. He reassured the commissioner that keeping her is a priority.

But Sabatine can’t wait around hoping things go her way. Unless additional financing can be secured, Film Indy will cease to exist in July 2018. Even if the credits pass, they wouldn’t take effect until that year, when her job might be gone. Whatever happens at the Statehouse next month, she needs to show progress to the groups that are funding her. She can sell the affordability of Central Indiana to studios. She can attend events like the upcoming Real Screen conference in Washington, D.C., where reality-show producers gather to field pitches from cities. She can chase stories like that of Lane Milburn, a San Francisco chef who recently moved to Indy to build a restaurant—ripe, in Sabatine’s view, for a documentary.

If the tax incentives pass, Sabatine expects her job to become more reactive. Given her up-front legwork, she thinks the phone lines will light up with producers interested in shooting here. If the credits don’t pass, she’ll continue what she has been doing—more trips to New York and L.A., more leaning on old friends to bring projects to Indy despite the lack of incentives. Because producers often plan films years in advance, a lot of what she accomplishes may not come to fruition during her tenure. “If you had asked me at 25 about a two-year commitment, I would have thought, That’s a long time!,” she says. “As I’ve gotten older, I’ve learned how long it can take to do something well. But what do I care if the productions come while I’m here? I just want them to come. If something I did makes this a better place in 2020, it’s still a win—whether I get credit for it or not.”

Which seems as good a place as any to fade to black. Sabatine just hopes there will be a sequel.