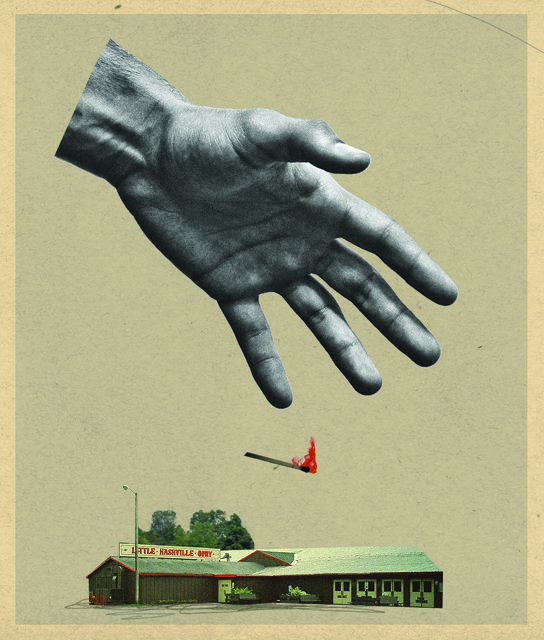

Burned: The Little Nashville Opry

The same things that make Brown County a tourist destination in the fall—the twisting roads, the hills bottoming into beautiful valleys, the thick quilt of oak and ash—make it a quiet and isolated place in the winter. Nashville, the county seat, may draw more than 2 million visitors each year, but its population remains around 800. And yet, this past January, every one of those residents was buzzing about the same thing: the arson trial surrounding the Little Nashville Opry.

For decades, the Opry hosted an astonishing roster of country-music stars, often selling out its 2,000 seats and sustaining many nearby shops, restaurants, and hotels. But on the night of September 19, 2009, a suspicious fire destroyed the concert hall. Almost immediately, attention turned to Esther Hamilton, the Opry’s octogenarian owner, and Jim Bowyer, the 77-year-old manager whom reporters delicately referred to as Hamilton’s “companion.” After a long investigation, Brown County authorities determined that Hamilton, the beneficiary of the Opry’s $3.6 million insurance policy, couldn’t have started the fire as a frail 84-year-old. But Bowyer, who appeared to live and share finances with her, certainly could have. And so authorities arrested and charged him with two counts of arson.

Most people in Nashville knew the Opry’s manager and owner. (Most people in Nashville know everyone there.) And together, the small town obsessed over the trial as it turned stranger and stranger—hundreds of thousands of dollars in business debts, the owner’s gambling habit, the flammable liquid poured throughout the venue, the lone truck screeching out of the parking lot on the night of the fire. And then, in January, came the strangest development of all: a verdict of not guilty.

“They didn’t put anything into the place,” a neighbor says of the manager and owner. “We knew what was going on.”

The jury’s decision stunned the sleepy hamlet, where comments posted to the local newspaper’s online coverage quickly turned ugly. As one Nashville denizen told IM, “Good luck finding someone who admits to knowing those two now. The entire community thinks they’re guilty as sin.”

The Little Nashville Opry first opened in 1975, and over the years, everyone from Johnny Cash to Willie Nelson stopped by to play—along with then-youngsters like Reba McEntire, Blake Shelton, and Toby Keith. Billy Ray Cyrus had a gig there when his heart was at its achy-breakiest. That night, cars with license plates from 21 states filled the Opry parking lot.

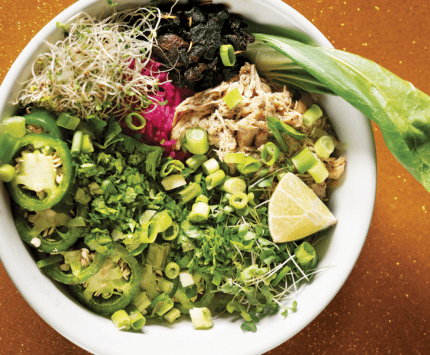

Today, the lot sits empty and cracking, flanked by two hotels. Stan Lucas owns one of the establishments, the Red Bud Inn, and he credits the Opry’s early success to DeWayne, Hamilton’s late husband. “The Opry was his life,” Lucas says. Like everything else in Brown County, the Opry depended on its rustic charm—wooden pews for seating, fudge for sale at concessions, and back-to-back shows on Saturday nights. But DeWayne also worked hard on his relationships with the talent and the fans, cultivating a mailing list of nearly 85,000 enthusiasts and making sure the stars always got a home-cooked meal in their dressing room. The Opry featured a top-tier sound system; whenever Loretta Lynn played there, she didn’t even bother bringing her own equipment. “They had good bands doing two shows a night, and that meant 4,000 fans,” says Ed Wrightsman, who owns the Green Valley Lodge on the other side of the Opry. “That’s a lot of meals, a lot of gas, and a lot of shopping.”

But the concert hall began to change following DeWayne’s death in 1996. Hamilton was already friends with Bowyer, a former Morgan County commissioner. “After DeWayne died, they became … better friends,” says Lucas. Bowyer offered to manage the Opry, and he and Hamilton kept luring big talent—including a chipper and profane Bob Knight, who entertained a full house in 2008. But the pair also cut costs. Lucas and Wrightsman say the two stopped the dressing-room dinners and quit buying ads on country radio. They shut off the air-conditioning during many shows, leaving performers miserable on the hot stage. And the fire investigation revealed that when the sprinkler system began suffering from leaks and busted pipes, they capped the water supply to more than half of it. “They didn’t put anything back into the place,” Wrightsman says. “We knew what was going on.”

While prosecutors argued that Boyer had the means, motive, and opportunity, arson cases can be difficult to prove.

Hamilton and Bowyer, their neighbors suspected, were more interested in visiting nearby casinos than in taking care of the Opry. Hamilton liked to play the slots, and they made quite a pair at French Lick or Shelbyville—him short, skinny, and animated; her tall and reserved, with hair colored bright red. What they shared was an appetite for gambling. That, and the ability, or a while at least, to fund those trips with cash from the Opry.

Just after 10 p.m. on September 19, 2009, a person driving down State Road 46 called 911. “The Opry, it’s totally on fire,” the caller said. “The whole place is going up right now.” (The building was empty at that hour—the Opr0y hadn’t staged a second, late show for some time.) It took nearly 65 firefighters to control the blaze. The Opry’s old-fashioned wooden walls, along with a flammable liquid investigators would later determine had been poured down the center aisle, provided the perfect fuel for the fire. Brown County residents as far as 12 miles away noticed a dip in their water pressure from the fight. In the lobby of the Green Valley Lodge next door, Wrightsman made coffee for the exhausted responders. “We were up a couple days straight,” he says.

The Brown County Sheriff’s Office suspected arson from the start, and it quickly brought in the Bureau of Alcohol, Tobacco, Firearms and Explosives. A comprehensive ATF audit of Hamilton, Bowyer, and the Opry showed that in the four years leading up to the blaze, Hamilton visited local casinos 800 times, betting $4.2 million and losing $150,000 of it. Bowyer, who had gone to casinos 650 times, lost even more. At the time of the fire, the ATF concluded, Hamilton had only $343 in her bank account. The Opry was also in dismal shape, with only $8,470 in the bank and more than $170,000 in expenses due the next month. Late in 2008, Hamilton had agreed to sell the Opry for $2 million to Scott Wayman, a businessman and country-music DJ. But six weeks before the fire, Wayman’s financer pulled out, convinced the Opry wasn’t worth the purchase price. By that point, the ATF’s audit revealed, Hamilton had spent almost all of the $250,000 Wayman paid in earnest money on casino markers and personal expenses instead of holding it in trust.

Hamilton and Bowyer appeared to be in deep trouble, and investigators turned up other disconcerting details. Back in 1984, Bowyer had offered to burn down a neighbor’s business so he could collect insurance money on it, the neighbor told prosecutors. Local news outlets reported that small fires had started on two other properties owned by the Opry manager—in both cases, Bowyer blamed space heaters—and Hamilton had been linked to three additional fires.

Bowyer said that on the night of the Opry blaze, he closed the place down and left before his two sound techs. But later Bowyer admitted to a detective that after leaving the building, he had driven behind the Opry by himself to “take a leak.” A few minutes later, a woman staying at the Green Valley Lodge stepped outside her room to smoke. She watched as a dark-colored pickup with a cap—the same kind that Bowyer drove—gunned it out of the Opry’s parking lot and into the darkness.

In the months and then years after the fire, ATF agents slowly built their arson case. Hamilton and Bowyer, for their part, had to get by without their primary source of income. The pair, who declined to be interviewed for this story, filed an insurance claim, but in 2011, a judge ruled that the Opry’s rundown sprinkler system negated the insurance company’s duty to pay. That same year, Bowyer was convicted of shoplifting chewing tobacco from a nearby grocery; the store’s owner testified that cameras caught Bowyer stopping by the deli on his way out to grab a cup in which to spit.

In 2012, Brown County prosecutor James Oliver charged Bowyer with arson. At the trial this past winter, Oliver argued that the manager went back inside and poured an ignitable liquid from the back door down the center aisle and all over the stage. Bowyer then lit the fire, left the Opry, and drove to Hamilton’s house, and the two headed to the casino in Shelbyville. Oliver says the judge blocked any testimony about Bowyer’s previous fires, ruling it unduly prejudicial, yet the prosecution still managed to call around 40 witnesses over seven days. One of them was Hamilton, who downplayed her financial trouble, saying she gambled “a couple times a month.”

John Boren, Bowyer’s lawyer, called just one witness, a man who claimed he’d seen a strange older car sitting in the Opry’s lot that night. Boren pointed out how fast Bowyer would have had to drive to set the fire and then get to Hamilton’s. While prosecutors argued that Bowyer had the means, motive, and opportunity, arson cases can sometimes be difficult to prove without a witness who saw the suspect actually light the fire.

When the jury foreman finally read the “not guilty” verdict, Bowyer put his face in his hands and wept. Oliver stood there expressionless. “We knew going in that this was going to be a tough one,” the prosecutor says. “But we thought it was too important not to present it to the jury. The Opry had a significant place in both the history of Brown County and its current economics.”

Scott Wayman, who tried to buy the Opry before, finally purchased the property at a tax sale for $58,000. Wayman plans to rebuild the concert hall and has even planted a big “Watch for Our Grand Opening …” sign just off of State Road 46. But clearing up Hamilton’s unpaid taxes has taken time, and he had to paint over the sign’s “… in 2013.” Still, Stan Lucas and Ed Wrightsman remain optimistic, largely because they have to be. While Brown County tourism has become more diverse (some visitors now come for the mountain-biking or zip lines), many businesses still need the concert traffic to survive. Lucas’s Red Bud Inn grossed $90,000 per year when DeWayne Hamilton ran the business next door. Today, its take has dropped under $30,000, and Wrightsman’s Green Valley Lodge has experienced similar troubles.

This spring, Wayman stopped by to show both owners the plans for the new Little Nashville Opry—a metal building this time, with the same 2,000 seats. “We just get up every morning and hope the construction trucks come in today,” Wrightsman says. “That’s all we can do.”

This article appeared in the May 2014 issue.