The Bizarre Story of the Liberty Dollar

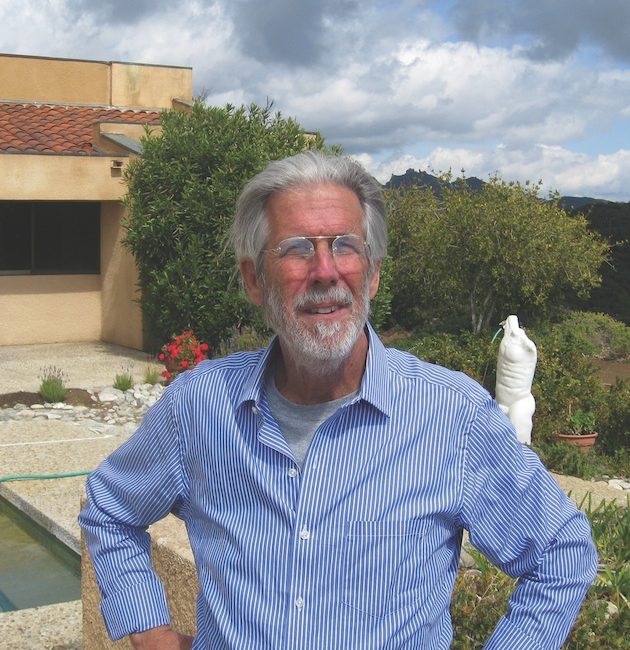

Say what you will about Bernard von NotHaus, the man has led his federal probation officers to some beautiful places. First, there was the waterfront penthouse in Miami Beach. Then the penthouse at the Marco Polo condominium in Honolulu. Today, he occupies a multimillion-dollar, 40-acre estate in Malibu owned by a longtime friend. Make no mistake, though: NotHaus is broke. Ever since the FBI raided the Evansville office of his alternative currency, the Liberty Dollar, in 2007—seizing his assets and arresting him for counterfeiting—the 68-year-old has been living on Social Security and the kindness of wealthy acquaintances.

Which explains how someone who drives a beat-up, ’90s-era Pontiac Grand Am received his regular visit from the probation department yesterday at a spectacular house with a driveway so winding and steep that the officer refused to ascend it.

Wearing a Hawaiian shirt and his long gray hair in a ponytail, NotHaus greets me at the front gate and welcomes me inside. His companion of 40 years, Talena “Telle” Presley, disappears to a back room. If he wants to do another interview, that’s his business. A documentary filmmaker from Los Angeles has been shooting him here lately, and the BBC plans to sit down with him next week. NotHaus wastes no time spreading dozens of old coins and bills on a table for the beginning of a monetary history lesson.

“Listen, the U.S. government has been printing billions of dollars a year,” he says. “That’s like watering down good Chivas whiskey! And it always leads to hyperinflation eventually.”

He picks up a worn bill with German writing and considers it.

“Back in January of 1919, it took 12 German marks to buy one ounce of silver. Then in November 1923, just four years later, a little guy with a moustache jumped on a table at a beer hall in Munich and said the revolution had begun. Usually, people don’t keep records of inflation during chaotic times, but the Germans did. And at the end of that year, it took 543 billion marks to buy the same ounce of silver. Are you familiar with the French assignat?”

He picks up another wrinkled note.

“Here’s one from 1792. The French thought, ‘Other people have f—ed up with paper money, but it can’t happen here. We know how to manage it.’ Well, during the rise of the Republic, the assignat entered hyperinflation and became worthless.

“Here’s an American colonial dollar from 1796. Ever heard the expression ‘Not worth a colonial dollar’? And look at this recent $100 trillion note from Zimbabwe.”

NotHaus gets so excited explaining the difference between these “fiat” currencies—those not backed by a commodity like precious metal—and his own Liberty Dollar that he can no longer remain in his seat.

“Mark my words,” he says, standing. “One day, gold will hit $100,000 an ounce, and silver will hit $1,000.”

Even the most avid supporter of returning our money to the gold or silver standard would have to be startled by that prediction. While it’s true that silver has risen from $5 an ounce to more than $30 over the past few years as Federal Reserve dollars have slowly depreciated, no calamity seems imminent. Yet, in less than a decade, NotHaus’s Liberty Dollar surged to become the most pervasive alternative to the American buck. His makeshift Indiana bank printed or minted more than $65 million—bills and silver coins that spread to buyers in all 50 states. Hundreds of merchants nationwide came to accept the stuff. And the bizarre story of how the Liberty came about, how the government came to see it as counterfeiting, and how NotHaus believes it still might save us from an economic collapse is richer than any currency can measure.

Bernard von NotHaus was born near Kansas City, Missouri, where his father was a salesman, his mother taught swimming lessons, and absolutely no one in the house was interested in economics. He studied architecture at Kansas State University for six years before dropping out to enjoy what remained of the ’60s in Europe. He claims to have traveled a little with John Lennon. Dated Lennon’s cook. Wandered around Pakistan and Afghanistan. Ultimately, NotHaus moved to Hawaii in 1971 for the same reasons everyone moves to Hawaii.

Living on Oahu in absolute poverty and happiness, he and his girlfriend, Telle, built a rustic little cabin together. They partied on the beach with the trust-fund crowd, smoked pot with the right people. Telle bore him two sons, Random and Extra. (When asked about the unusual names, NotHaus offers only that “they’re unusual boys.”) And then on Sept. 11, 1974—he has no problem remembering the date—NotHaus had an experience that he says defined the rest of his life. A spiritual visitation. A voice invoking him to spread the word about gold. An “epiphany.”

“It ebbed and flowed over a period of about two weeks,” he remembers at the Malibu house, his eyes welling with tears. “And it was wonderful. I had no background in economics. Come to think of it, I still don’t—it’s dry, boring. Money is cool. Anyway, at the end of it, I knew I had to write this economic research paper.”

NotHaus knows how delirious that sounds. “You can make fun of it if you like,” he says. “But there are religions where God comes to you on a little wafer. They had some good people selling that one. Imagine marketing a crucifixion as a beautiful experience. Give me a naked woman and a joint.”

So the hippie apostle of no one in particular read up on the history of gold ownership and wrote his gospel on its potential to rescue us from a coming depression. The 21-page report, titled simply “To Know Value—An Economic Research Paper,” studied the devaluation of the dollar over the last century along with gold’s relative steadiness. Simplified charts were thrown in for good measure. And here’s the strangest part: It made a decent argument. NotHaus began selling copies of the paper for $3 to his friends in the neighborhood. “People thought, ‘Bernard has lost it!’” he says with a frenzy in his eyes that suggests he might have. “I didn’t even point out that private ownership of gold was illegal at the time!” That decades-old prohibition, intended to reserve the metal for federal purposes, would change shortly thereafter, in December 1974. And after reading NotHaus’s paper, several of his wealthy Hawaiian friends decided they wanted some gold of their own.

Now blessed with a market for precious metal, NotHaus had a problem. He didn’t know the first thing about minting. A more orthodox person might have taken a few classes. Instead, NotHaus called every private mintmaster he could find until one in California named Earl Butler grudgingly agreed to share a few secrets over the phone. Still, it was a complicated process—melting, rolling, tumbling, die-making, pressing. Perfecting it took time. And there was this added complication: NotHaus didn’t own his own press. But his friend Henry Stotsenberg, a young consultant living in Hawaii and eventual owner of the Malibu house, knew financiers and how to pitch them for the $100,000 loan the operation needed.

NotHaus got his press.

By the early 1980s, the Royal Hawaiian Mint, as it came to be known, was churning out some of the most beautiful collectible coins in the country. The medallions commemorated everything from the anniversary of Pearl Harbor to the historic kings of the islands. Dignitaries such as the governor of Hawaii would even come out for their release on occasion. Advertising his gold and silver pieces in numismatic magazines such as Coin World, NotHaus slowly became a rich man. He moved his family to the exclusive Diamond Head area. His son Random attended the Punahou School, from which Barack Obama had graduated. NotHaus and his boys would travel the world for two months each year, “Captain Rough Seas and the Crew of Two,” visiting mints, collectors, and others related to the industry everywhere they went. All the while, he continued to study monetary theory. Though he would spend 25 years at the Royal Hawaiian Mint, his time there served as financing for a loftier goal—one that had nothing to do with collectibles. NotHaus abhorred the Federal Reserve’s relentless printing of fiat money and the accompanying depreciation of the dollar, which had lost almost half its value in his lifetime. If he could create his own system of money based on silver or gold, he thought, he might be able to protect the American people not only from inflation, but something far worse. “Every country that has hyperinflated its currency has ended up in a dictatorship,” he says. “Societies collapse in the absence of value.”

NotHaus began to design a new system of cash based on gold and silver. He sketched out the paper bills, experimented with molds that would make the coins, and used his savings to buy thousands of ounces of gold and silver bullion. By the summer of 1998, all he needed was a name for his newly minted operation and a more centralized U.S. location than Hawaii for its headquarters. The Liberty Dollar began its life under the clunky moniker “National Organization for the Repeal of the Federal Reserve” (NORFED). And as he began to publicize his plan among libertarian and anti-establishment groups, NotHaus received the break he needed: a call from a man named Jim Thomas of Evansville, Indiana.

Silver and gold. They have staying power. Civilizations have been using them as currency for thousands of years, and for most of the last two centuries, American cash was backed by one or the other. The U.S. started using silver dollars in the late 1790s, a period in which hundreds of banks were still printing their own money. When the country began issuing greenbacks during the Civil War, you could trade them in for gold at any time. The wisdom of that system has been fiercely debated ever since. Although Franklin Roosevelt effectively ended the gold standard in 1933, freeing up the country to print as much cash as necessary without requiring stockpiles of metal to back it, opponents persist to this day. Presidential candidate Ron Paul has advocated for a return to money backed by precious metal. He even mentioned the Liberty Dollar on the floor of Congress in March 2011.

But what was life like under the gold standard? “It was awful,” says Richard Cooper, a professor of economics at Harvard University and former chairman of the Federal Reserve Bank of Boston. “The American public today would find it completely unacceptable. So I’m bemused by these people who want to get back on it. If you can only issue money against gold or silver, you’re depending on the production of those metals. And what determines production? Availability of ore and price. So you’re completely dependent on the accidents of discovery. It’s a foolish standard.”

“I had no background in economics,” NotHaus says. “It’s dry, boring. Money is cool.”

Cooper, who personally dissuaded Ronald Reagan from returning the country to the gold standard in the early 1980s, considers the idealized view some have of it as misguided nostalgia. In times of turmoil such as war, he says, countries tend to suspend gold payments anyway. Not a single silver- or gold-backed currency survives today anywhere in the world.

A few domestic alternatives to the U.S. dollar do exist, however, and for the most part, the federal government has shown little interest in challenging them. Since 1991, a small collective has been printing Ithaca Hours bills in New York, where they are exchanged locally for goods and services. In Massachusetts, another group produces fairly sophisticated notes called BerkShares for the same purpose. As many as 30 alternative currencies exist in the U.S., some of them churning out hundreds of thousands of dollars. They don’t look much like legal tender, they’re not backed by precious metal, and no coins are involved. But in many ways, the other alternative currencies aren’t so different from what NotHaus set out to create in 1998. He just proved to be a lot more ambitious.

Among conspiracy theorists and right-wing subversives, Jim Thomas was a national hero. For most of the 1990s, he published a magazine called Media Bypass from a two-story building on Tippecanoe Drive in Evansville. Questionable exposes about government cover-ups filled its pages, most famously a 1995 story that contained the first interview with Timothy McVeigh, alleging that the Oklahoma City Federal Building bomber had been a pawn. On almost every political issue, Thomas held strong libertarian opinions. Can it be any surprise that he believed the country was headed for an economic apocalypse? When he heard about NotHaus’s idea in the summer of 1998, Thomas called and invited him to visit Evansville. The man now referring to himself as a “monetary architect” accepted.

NotHaus liked what he saw in Southern Indiana. A central location from which to distribute the Liberty Dollar nationally. A partner willing to rent out space in the magazine’s office. Ready-made employees currently working for Thomas. And Sarah Bledsoe, who would become his office manager, who remembers feeling a little overwhelmed by NotHaus’s enthusiasm for a subject she had given little thought. “He asked me what I knew about money,” says Bledsoe, whose previous job had been attaching clothing tags at a T.J. Maxx factory. “I said, ‘I know how to spend it.’ So I shifted over and starting working for Liberty Dollar.”

NotHaus acquired a mobile home and moved to Evansville, where he spent the next six months getting his currency off the ground. Having met with printing presses and mints across the country, he partnered with two to manufacture his bills and coins: Sunshine Minting in Coeur d’Alene, Idaho, and Pro Forms in Porterville, California. Printed on high-grade cotton, the bills boasted security features that would be the envy of some national banks. In addition to a hologram, the multicolored $1s, $5s, and $10s—backed by silver, of course—contained a thin line around the edge that appeared decorative but revealed a micro-printed Preamble to the U.S. Constitution when viewed under a magnifying glass. Each bill carried a unique serial number, which independent auditors would use to verify how much was being printed. The coins were no less impressive. Weighing one ounce, the Silver Liberties applied everything NotHaus had learned during his time at the Royal Hawaiian Mint. The negative space on the coin’s face, called “the field,” turned almost black when viewed at certain angles—a hallmark of immaculate minting. And each hair on “Liberty’s” head, carved in the foreground, seems to have been carefully considered.

Stories surfaced of select locations of Walmart and McDonald’s taking the silver pieces.

The initial distribution system NotHaus designed was simple: Sunshine Minting would manufacture the coins; Pro Forms would print the bills. Then they would send them to the national fulfillment office in Evansville, which would mail them to customers nationwide. The bills could be mailed back in and exchanged for silver at any time. Orders were slow in those first six months, and NotHaus spent much of his time making phone calls to like-minded libertarian groups, hoping to find an audience. Not surprisingly, very few merchants were willing to accept the Liberty Dollar at first. Banks certainly wouldn’t deposit them. But NotHaus, Thomas, and their handful of employees would leave the bills and coins as tips at Evansville’s famous Gerst Haus and other restaurants, where they were often met with curiosity. The gun shop next door, Strictly Shooting, started accepting them. Then the hair salon down the street did, too. “There are people in this country who are fed up with the government, and they’re looking for something different,” says Terry Rice, who owned Strictly Shooting at the time. “Well, the Liberty Dollar was something different. It’s not like everybody who walked in the door had some in their hand, but when people saw them in the register, they wanted them as change. More than anything, it was an anti-government statement.”

With thousands of dollars soon coming in and out on a regular basis, security should have been a concern at Liberty Dollar, but it wasn’t. The operation moved to a rented house on Morgan Avenue, where the safe sat on a screened porch out back. The Evansville Courier & Press ran a story on the small enterprise, but for the most part, it operated fairly quietly. Bledsoe, the office manager, had a hard time explaining what she did to her friends. Try as she might, most of them assumed the business was making collectible coins. But she remembers being at the grocery one day and seeing a Family Circle magazine with an article about alternative currencies such as the Ithaca Hours. “I thought, ‘I’m doing that too!’” she says. “It never crossed my mind that we might be doing something illegal.”

Content that the Liberty Dollar had taken root in Evansville, NotHaus hit the road in 1999 to market it across the country, and would return only a few times a year thereafter. He spoke at whatever library or libertarian meetinghouse would have him. He edited and published The Liberty Dollar Solution to the Federal Reserve, a book that compiled essays by notable economists about the merits of silver and gold. (A young Alan Greenspan: “In the absence of the gold standard, there is no way to protect savings from confiscation through inflation.”) Glenn Beck interviewed NotHaus on Headline News. The Learning Channel aired a feature that talked about his currency. Everywhere he went, he gave away T-shirts, Frisbees, and bumper stickers (“Fed up?”).

As it turned out, there existed an enormous untapped, albeit fringe, market for a currency backed by precious metal. By the early 2000s, the price of silver had begun its steady climb from $5 an ounce to more than $30, a period during which Liberty Dollar was filling orders for thousands of ounces a month. NotHaus claims most of the profits were funneled back into the business, and no definitive evidence has surfaced to suggest otherwise. The headquarters moved once again to a large strip mall on North Stockwell Road in Evansville. Thomas retired in 2004, but by then, NotHaus had several employees who spent the day busily shipping orders. Hundreds of independent businesses across the country had begun to accept his currency, and he was happy to provide customers with a list of them in their area. Stories even surfaced of select locations of Walmart and McDonald’s taking the silver pieces. NotHaus decided to create regional currency officers, who would be responsible for recruiting merchants and consumers in their area. Alan McConnell, who lives on the east side of Indianapolis, had first visited the Evansville headquarters in ’98 and had followed the Liberty Dollar ever since. An independent publisher, McConnell shared NotHaus’s belief in the potential of silver to ward off inflation. He signed on to become the Central Indiana RCO in 2005.

Agreeing to buy the Liberty Dollar in bulk at a discount and sell it to the masses, McConnell hosted meetings at the Lifegate community center in Beech Grove. Occasionally, he would spend the currency at the Subway on South Street downtown or the Marathon gas station at 34th Street and Keystone Avenue—anywhere he could find a sympathetic manager or cashier. While McConnell admits he might not have been as driven about soliciting new business as some of the other RCOs, he did believe in a coming economic collapse, and he targeted an unexpected group when promoting his product. “I was particularly interested in educating policemen and firemen about it,” he says. “They’re our first responders in times of crisis, so I thought it was important that they knew. And they seemed to like it. I was never hassled about it.”

Nationally, millions of Liberty Dollars were circulating by 2006. And that’s when a sign of trouble arrived in the mail. On September 14, NotHaus received an ominous warning from the U.S. Mint. It wasn’t a cease and desist, exactly. But the note made clear that from the federal government’s point of view, “the use of these gold and silver NORFED ‘Liberty Dollar’ medallions as circulating money is a federal crime.” NotHaus consulted his lawyers, who disagreed. So the organization continued to produce the currency undaunted.

And that might have been the last of NotHaus’s troubles if it hadn’t been for the owner of a pizza shop in Asheville, North Carolina. During that period, the now-anonymous shop owner took a Liberty Dollar she had accepted to a bank and tried to deposit it. The bank refused and contacted the local police, who contacted special agent Andrew Romagnuolo of the FBI’s Asheville office. Romagnuolo assigned undercover agents to buy the currency from a regional office being operated from an attic in Asheville. Agents later attended meetings in that area intended to drum up business for the money. After investigating the matter for several months, the FBI decided it was time for a visit to Southern Indiana.

Sarah Bledsoe arrived at Liberty Dollar headquarters for work on the morning of November 14, 2007, prepared for a busy day. Inside the beige strip mall with a green awning sat thousands of ounces of copper coins bearing the face of Ron Paul, a new product that the business would be shipping out in the coming weeks. A few police cars sat in the weedy parking lot as she prepared to unlock the front door, but she paid them little attention—cops always seemed to be patronizing the adjacent gun shop. Then, suddenly, 20 of them surrounded her. Agent Romagnuolo and others marched her inside and waited for more employees to arrive, including long-time associate Rachelle Moseley. The FBI questioned the women separately, pressing both with one question repeatedly: “Where is Bernard von NotHaus?”

Unbeknownst to Bledsoe and Moseley, the FBI was simultaneously raiding Sunshine Minting in Idaho. There, the authorities arrived to find tons of silver and gold belonging to Liberty Dollar. In a moment of excitement, they insisted they would be seizing the 40,000-pound presses along with everything else. Sunshine reminded the authorities that it needed the machinery for another high-profile customer: the U.S. Mint. Sunshine produces silver blanks for the federal government.

Back in Evansville, Bledsoe phoned NotHaus, who was about to step into a meeting in Florida. “We have visitors,” she said, “and they’re taking the place apart.” He told her to refuse any further questions. The FBI rented a U-Haul and carted off the Ron Paul copper dollars, thousands of Liberty Dollars, and $254,000 in Federal Reserve currency in addition to computers and the contents of the safes. NotHaus booked a flight to Indiana.

Standing in his ransacked headquarters the next day, NotHaus tried to reassure his employees and customers that everything was going to be fine. In a video that can now be seen on YouTube, he jokingly welcomed any undercover FBI agents who might be in the room. But those who know him say he was clearly shaken. “I walked in on him sitting in his empty office with his head down,” Bledsoe remembers. “He said ‘Maybe we need to give this thing up.’”

In June 2009, NotHaus, Bledsoe, Moseley, and Kevin Innes—the regional currency officer who controlled North Carolina, where the investigation began—were arrested for counterfeiting, a curious charge given the currency’s anti-government marketing. Bledsoe, who had never even had a speeding ticket, says the U.S. Marshals arrived at her workplace with guns drawn. All of them were summoned to a federal court in Charlotte, where they faced felony charges. Unwilling to risk jail time for a crime they didn’t know they were committing, Bledsoe, Moseley, and Innes signed pre-trial diversion agreements in exchange for probation. But NotHaus was not about to admit guilt.

Over the next three years, as NotHaus remained out on bond, the government built its case. He had violated two U.S. Code sections under the umbrella of counterfeiting, they said, and one that amounted to conspiracy against the United States. The U.S. Code specifically prohibits the manufacture of coins intended to be used as money—whether they resemble U.S. coins or not—a charge against which he could scarcely defend himself. But from there, it got hazier. NotHaus was also charged with making coins in resemblance of U.S. coins, basically traditional counterfeiting. Whether the Silver Liberties fit that description is debatable. Prosecutors argued that the coin’s use of “Trust in God” rather than “In God We Trust,” the word “dollar,” and the “$” symbol, among other similarities, were enough. But as beautifully produced as the coins were, the back of them featured a website; few would mistake it for U.S. coinage. Not to mention the fact that he was trumpeting them as competition to Federal Reserve dollars. As NotHaus points out, “If I wanted to be a counterfeiter, I’d be very good at it. This was something different.” And the law says nothing about making paper bills not resembling U.S. money, one reason the government may have decided not to pursue that aspect of his operation. As for the conspiracy charge, prosecutors called NotHaus’s challenge to the Federal Reserve “a unique kind of domestic terrorism.” His stubborn refusal to discuss a plea, along with his raging anti-government rhetoric, had struck a nerve.

NotHaus felt he couldn’t possibly lose at trial. In fact, he had actively petitioned for charges to be brought so he could publicly defeat them. “I’ll be goddamned if I’m denied my day in court,” he said in a 2008 profile for the online magazine Triple Canopy. “I have to be arrested!” NotHaus urged his lawyers to refer to the Constitution, not the statutory law. While article 1, section 8, clause 5 states that Congress shall have the power “to coin money, regulate the value thereof, and fix the standard of weights and measure,” it does not say it has the “exclusive” power, a word NotHaus argues the founding fathers used generously where they desired it. And as many learned in grade school, those powers not granted to the federal government or the states are granted to the people.

Whether that would have resonated with the jury can’t be known. His attorneys mounted a more traditional defense focusing on the statutes, and the jury was not impressed. On March 18, 2011, they found NotHaus guilty on all charges after less than two hours of deliberation.

Two weeks after the verdict, The Wall Street Journal published an op-ed piece condemning the decision. “It may be … that the government has overreached in the NotHaus case,” wrote conservative pundit Seth Lipsky. “Certainly, it’s a loser’s game to suppress private money that is sound in order to protect government-issued money that is unsound.” At a press conference, Ron Paul also questioned the legitimacy of the prosecution. “The best thing that could come of it is a real, honest Constitutional debate about what money is,” he said. “If these individuals were actually practicing civil disobedience, they could be Constitutionally correct but legally wrong … these are worthy things to do.”

Friends with money came to NotHaus’s aid as well. Thus the Malibu house and other places he has lived as he awaits sentencing. As of publication, that still hasn’t been scheduled—an unusual delay, although the presiding judge, Richard Voorhees, is known for taking his time. Facing a potential 25 years at the age of 68, NotHaus acknowledges that he might die in federal prison. With typical bravado and a hippie proverb, he dismisses it. “That judge can take as long as he likes to rule,” he says. “You ever do any hitchhiking? There’s a saying among hitchhikers: ‘The longer the wait, the better the ride.’ I never considered a plea. This is about principle. If I’m going down, I’m going down hard.”

Prosecutors won’t talk on the record about the case because it remains open, but they characterize it as garden-variety counterfeiting. They argue that while there may be elements of the currency that don’t match U.S. coinage, the similarities were designed to deceive people into thinking the coins were legitimate. Only one victim confirmed that idea in court. Thousands of individuals with orders in process did lose money in the raid, though. Even more who own the paper bills lost access to the silver those notes represented, some to the tune of $100,000. A forfeiture trial will follow sentencing to determine what happens to Liberty Dollar’s eight tons of precious metal, currently sitting in a federal vault in Dallas, Texas. Customers hope to be made whole, but a judge might also rule that the material is federal property because the victims knowingly entered into a fraud. Not surprisingly, most of them are furious at the government; few seem to be angry at NotHaus.

Liberty Dollar coins are now classified officially as contraband—illegal even to own—although legions of them are likely stashed away in drawers and fire safes across the country. Some continue to trade on eBay, where they sell at a hefty markup. A Silver Liberty can go for about $60, twice its silver value. Some of the rarer ones bring $1,000. The prosecution in this case has indicated it won’t go after individuals who simply own some of the currency, but that selling it puts a person at risk. Like many of the regional currency officers are likely doing, Indy’s McConnell is sitting on an untold amount of it, waiting to see how this all plays out. His support for his old business partner does not fear hyperbole. “No one has sacrificed as much for freedom as Bernard,” he says. “He’ll see this through to the very end.”

“I never considered a plea,” NotHaus says. “If I’m doing down, I’m going down hard.”

Ever the optimist, NotHaus believes he has an excellent chance on appeal. And he’s not the only one. There isn’t much case law in this area, and experts are even scarcer. “I can’t say I’ve ever seen a case like it,” says Gerard Magliocca, a professor of law at IUPUI who has studied related issues. “You have to ask yourself if counterfeiting law was intended to include something like this. Arguably not.” NotHaus intends to press the issue all the way to the Supreme Court if necessary, although Magliocca cautions that the high court rarely takes oddball cases like this one, even when there are Constitutional issues involved.

In Evansville, very little trace of the Liberty Dollar remains. Jim Thomas died in 2010; Sarah Bledsoe and Rachelle Moseley moved on to other jobs. The strip-mall headquarters on North Stockwell Road now sits empty. NotHaus visits friends there on the rare occasion the court allows him to travel from state to state, although sentencing may put an end to that.

Shortly before publication, I called NotHaus in Malibu, where he was working in the vineyard. The BBC interview had been “grueling,” he said, but he was looking forward to one with NPR. And since my visit, HBO had expressed interest in the documentary about him. All the attention assured him that his dream of “restoring value” to our money remained very much alive. If he weren’t a federal criminal, you’d swear he had the Midas touch. He had even made a new friend. “I just met the guy who owns the adjoining property, and he’s a hard-money guy, too!” he said. “He’s hosting some high-profile liquidity expert from Wall Street today at his house. I may pop by.”

I asked him about his many supporters, some who still send a few Silver Liberties and coins from the Royal Hawaiian Mint to help him get by in paradise. NotHaus is strictly forbidden from selling the pieces. But he told a story about a friend who had recently sold a few for about 100 times their face value. The pride in his voice was unmistakable. “Most things like that don’t appreciate until the creator is dead,” he said. “And I’m still very much alive.” Then he paused, and at the risk of implicating himself, couldn’t resist poking one last stick in the government’s eye.

“What’s a poor boy to do but make a couple of dollars?”

This article originally appeared in the July 2012 issue.